3 Reasons Why Mapping Condo Concentration Matters

The construction rate of multi-family dwellings in Canada shows record highs being posted in the last 5 years. This presents some unique challenges when analyzing data sets. Multiple units can exist within a single address, an important consideration when mapping and developing your analysis.

Let’s review 3 potential issues and what to do about them.

The Impact on Infrastructure

Condos require services, meaning they will draw heavily on existing infrastructure. The Ministry of Government and Consumer Services, for example, commissioned a report on elevator availability and maintenance. The request for proposal, which was issued by the Technical Standards and Safety Authority states “Ontario is currently experiencing one of the largest construction booms in residential properties in North America (and) a rapid growth in the number of elevators.”

High-rise construction requires specific planning of services, as higher densities can break traditional models that are based on regional boundaries. The ability to sketch out the density caused by high rise building enables analysts to better define territories in modelling out future service requirements.

Book of Business Modelling

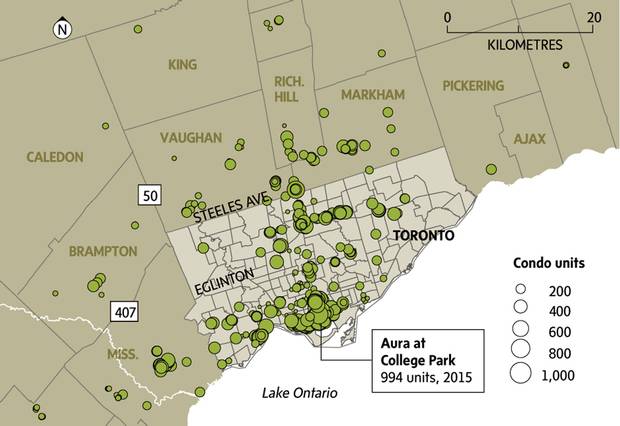

Over 109,000 condo units were added to the downtown Toronto market since 2010. Insurers have an ever increasing need to model their current and prospective business against the current condominium market. This will ensure they are not over or under represented in certain buildings. This can be challenging for any new building to ensure proper targeting of new business and ensure current business are not overrepresented.

The following graphic shows the state of condominium builds since 2010 in the city of Toronto – note the variability in the number of units in each area – and the resulting impact on any book of business.

Marketing to Highly Profitable Clients

The opportunity for utility and telco to maximize profitability is high in the condominium and multi-family dwelling market. You’ll be able to bring services to a high number of users with minimal expense. It does, however, require marketers to target end users accurately and understand who is within reach.

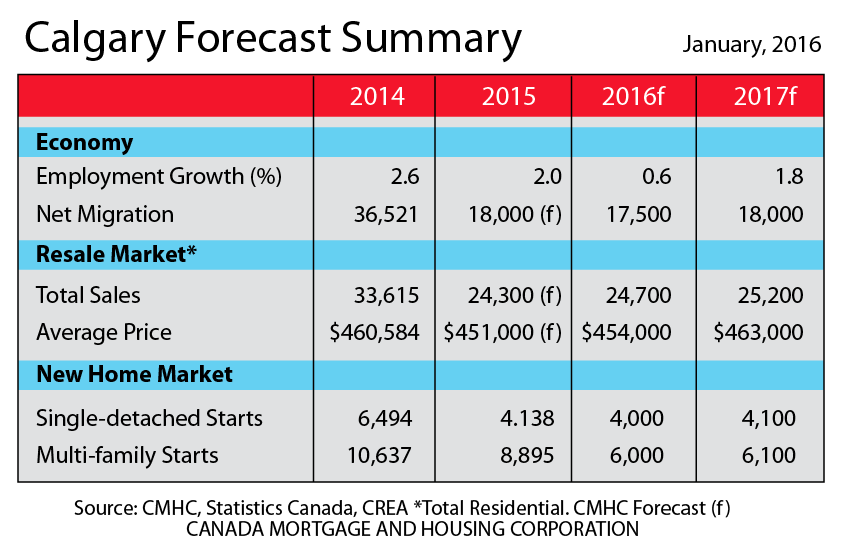

This is an opportunity that plays out across major markets throughout Canada. The following chart shows the expectation of continued higher production of multi-family starts vs. single-detached for the city of Calgary.

Marketers and operations managers have an excellent opportunity to combine their current client data with accurate location intelligence data. This will help them understand where new, profitable business opportunities are emerging across the country.

Check out the new DMTI / Teranet Condo Concentration Insights offering here if any of these business scenarios apply to you.

Here are helpful links if you are looking for Mexico Business Data, U.S. Real Estate Tools or U.S. GIS Mapping Technology