Mitigating Flood Risk with Location Intelligence

While some weather patterns are predictable, extreme weather events tend to run on their own calendar. Unfortunately, severe weather events have a tendency to cause the most damage and are occurring on a more frequent basis, resulting in a substantial financial impact on Canadian insurers. According to Catastrophe Indices and Quantification Inc. (CatIQ), in 2018 insured damage from severe weather events across Canada reached a staggering $1.9 billion.

Canada will no doubt continue to experience catastrophic weather events, but insurance professionals have solutions available that can help mitigate risks and reduce the financial impact of these events. Location Intelligence is an emerging field that provides substantial benefit to the insurance industry – from policy quote and approval processes through to claims management and customer service.

Advances in cloud computing are enabling insurers to migrate traditional geospatial analytics from an off-line manual process to real-time integrated solutions and automated workflows. Using location as a common point of reference, users are able to connect policy, property, claims and third-party data together to gain insight into the property and the surrounding area – allowing them to quickly analyze, visualize and assess property risk.

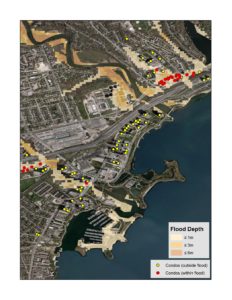

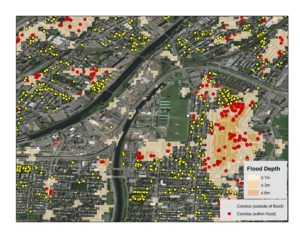

One common use case is the real-time, automated analysis of a proposed policy vs flood zones, earthquake zones and other potential perils. Getting a high precision view of where a property sits versus identified risks, allows for more accurate assessments. The availability of real-time location data offers two primary benefits. The first is increased productivity, delivered by automating assessments and consolidating the output on one screen so that agents can make better faster decisions. The second is proper pricing for the risk scenarios being proposed. The key to enabling these benefits is to empower the end user with information in real time.

While an agent is assessing the risk of a potential property, location data can answer a multitude of questions: Is this property exposed to a 1/20, 1/100, 1/200, or 1/1500 year flood event? What are the types and magnitude of historical claims in the surrounding area? Is my accumulation risk too high, or am I able to take on any more policies in this area? Are the current policies priced to cover identified risk? The answers to these questions are imperative when an insurer is trying to accurately calculate total risk exposure from perils and flooding, and accurately quote the policy in a timely manner.

While severe weather events and flooding will continue to present risks to Canadian insurers, access to real-time location data, including flood information, can enable insurers to make more informed decisions during the approval process. While the weather will continue to be unpredictable, location intelligence is a powerful tool to protect your bottom line.

To learn more read our White Paper: Mitigating Risk with Location Intelligence

Additional Reading:

Top 3 Ways Location Intelligence Empowers Underwriters