How Spatial Technology is Transforming Customer Experiences in the Insurance Industry

Using Spatial Technology to Improve the Customer Experience in the Insurance Industry…While Increasing Profits

Customer experience in the insurance industry is a hot topic, and it’s easy to see why. A strong customer experience is the key to growth and profitability, requiring many companies to focus on differentiating their customer experience to stay ahead of the competition. However, despite the obvious benefits of cultivating happy customers, many insurance providers struggle with how to deliver a great customer experience and increase profits.

You must find ways to maintain the integrity of your business alongside ways to serve customers better – because if you don’t someone else will. In a 2016 letter to his shareholders, Amazon CEO Jeff Bezos explained that being customer-centric is about staying ahead of customers and developing new ways to keep them happy. Bezos says that if you shift your focus from trying to create great customer experiences, then you’re already on your way down.

Insurance providers are concerned that providing better customer experiences could conflict with the established rules and processes they’ve developed for risk selection and pricing. This certainly doesn’t have to be the case. The solution is using a spatial technology platform that supports and strengthens existing workflows while helping develop meaningful digital experiences for customers.

Digital Customer Experience in the Insurance Industry

In today’s tech-enabled world, your customer’s digital experience plays a huge role in how they perceive your company. Your website is often a customer’s first touch-point with your company and will be the first time they assess if you can meet their needs. Studies show you’ve got less than 1 minute to convince website visitors whether or not they should try your product or service. In insurance, that translates to showing customers they can expect fair pricing and an efficient turnaround time.

That’s where your spatial technology platform comes in.

Use Spatial Technology to Deliver What Customers Want

People expect online experiences to be simple and intuitive and they are accustomed to instantly accessing the information they want. In the insurance industry, providing a great customer experience means being able to quickly deliver information or a plan for coverage. Leveraging a spatial technology platform enables automation and self-service, making the process of generating insurance quotes and pricing simple, fast and efficient.

More and more insurance companies are experiencing the transformative effects of automation, including improved accuracy and efficiency. Data gathered by customer inputs can be automatically delivered into your underwriting process, and remain consistent with the risk selection and pricing models developed by your company’s actuarial/risk group. A well-defined process can easily interface with a spatial technology platform to automate inputs for calculation resulting in instant assessment and pricing.

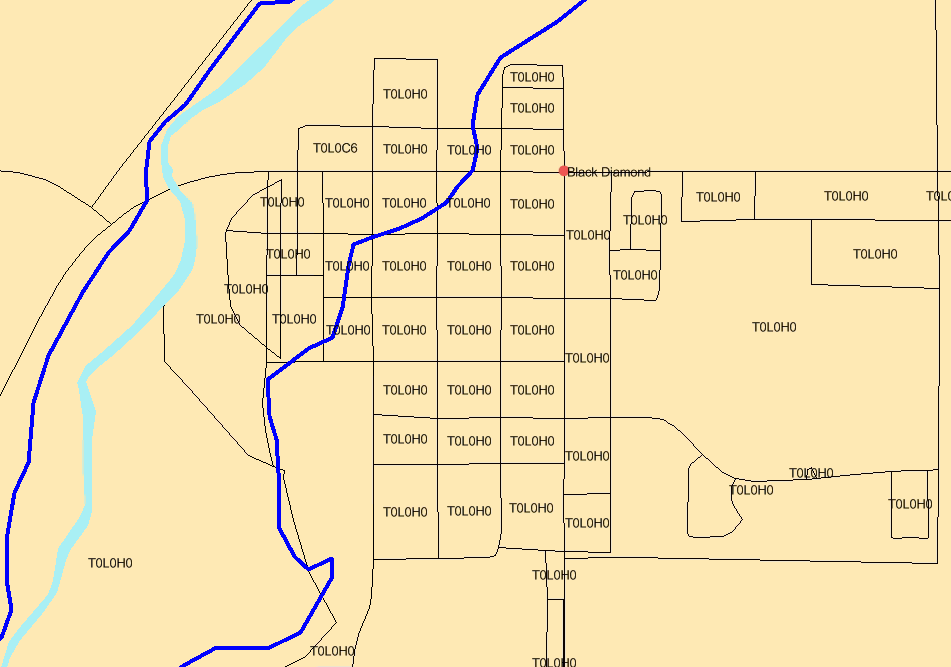

Spatial technology platforms deliver location-based insights, including tools like geocoding, digital mapping, data analytics and visual dashboards, helping insurers use location intelligence throughout the policy lifecycle to deliver on client needs without sacrificing profitability. Using automated workflows, your spatial technology platform will geocode addresses in real time providing high precision coordinates, and automatically cross reference this data with the appropriate risk factors within your risk assessment models and pricing engine.

In addition to improving profitability by streamlining customer’s access to plans and policies, spatial data paired with customer information can also be used to assess additional plans that consumers may not realize they could benefit from, therefore offering ample opportunity for your company to cross-sell or upsell additional plans and features.

Using Spatial Intelligence to Improve Risk Assessment and Pricing

A strong spatial technology platform provides the location-based insights and analytics necessary to support underwriting, exposure management and claims. This data allows you to improve auditability with defined automated rules and quickly aggregate and visualize location information for more effective and accurate analysis when determining risk.

Real time location intelligence helps insurers quickly respond to policy applications, catastrophic events, and claims with greater accuracy. The ability to apply geographic coordinates (geocoding) to the property of interest offers insurers the ability to associate complex data sets with those coordinates, enabling deeper insights on concentration risk and exposure to hazards. This includes earthquakes, flooding, windstorms and more. These insights can better enable no-touch, low-touch adjudication processes, or provide better insights through visualization for exception handling or portfolio risk analysis.

Finally, the data on a strong spatial technology platform is continually updated to reflect the most current, precise location data, improving risk assessment to ensure accurate pricing.

DMTI Helps Insurance Companies Improve the Customer Experience

When it comes to developing a great customer experience in the insurance industry, it’s important to keep things simple. Companies now have the tools to gather data on what customers want and need to keep them happy, loyal to your brand, and refer you to other potential customers. Using spatial technology, you can manage and monitor risk exposure in real time, with complete location data on one platform.

DMTI is the gold standard for GIS and location-based data in Canada, offering insurers scalable on-demand tools that support real time workflows. DMTI Spatial’s Location Hub® & UAID® is the only solution of its kind in Canada, and supports you company’s risk assessment process by delivering data visualization tools, and data delivery infrastructure to provide high-precision location accuracy.

Click here to find out how DMTI will help your insurance company experience greater growth and profitability.