Doing Business In Mexico: The Largest And Only Location-Based Mexico Business Dataset

Doing business in Mexico?

Growth-minded companies are increasingly investing in and marketing to businesses in Mexico. This emerging market offers huge potential with a stable economy and currency, a growing middle class, skilled workforce, and low cost of manufacturing. Plus, free trade agreements offer favorable incentives, making it easier to do business in Mexico than in many other countries.

If you’re looking to invest resources in Mexico, you need reliable and accurate information to ensure that your decisions support current business objectives. Knowledge is your greatest asset when doing business in Mexico and location-based data should be central to your research as you look into the assets and resources that will help your business grow.

Leveraging location-based data will help you uncover reliable partners, opportunities, and most importantly, provide the knowledge you need to support your decisions.

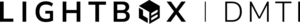

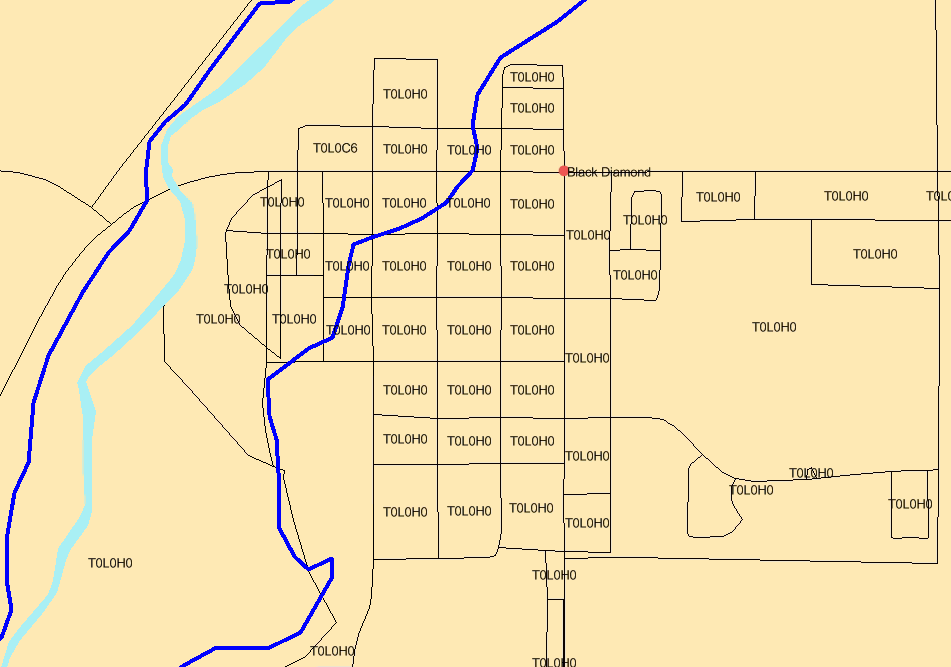

See the map below to understand our coverage by state:

What is Location-Based Data?

First, an explanation of exactly what location-based data is and why it’s important. Also known as ‘location intelligence,’ location-based data displays information layered onto a map. It shows how various points of information spatially relate to each other, helping to support analysis and decision making.

Maps bring information to life, allowing you to understand information and relationships geographically, and uncover valuable insights.

How Location-Based Data Helps You When Doing Business in Mexico

Growing any business involves risk and reward. Risk increases when expanding into a new market. Foreign competition in Mexico is growing as more businesses recognize the advantages of doing business there. This means you need to identify the best opportunities quickly and act on them as soon as possible. Making effective decisions begins with leveraging accurate location-based data.

Once you’ve evaluated your needs, you need to do research and analysis to support your objectives. Location-based data allows you to get very familiar with target geographies or industries, helping you to find the most cost-effective dataset.

For example, if you’re looking for people and companies you want to do business with, here’s a summary of the data fields available:

- Industry Sector

- Major SIC Category (2 Digit)

- Sub SIC Category (4 Digit)

- Product or Service Description

- Company Name, Address, Colonia, City, State, Zip/Postal Code

Also, our location-based data can be delivered as a complete dataset or as a subset. Here are our most popular subsets:

- Point of Interest (POI) Dataset

- Mexico Manufacturers Dataset

- Mexico Email Dataset

- Mexico Importers and Exporters Dataset

- Mexico Wholesalers & Distributors Dataset

- Mexico Retailers Dataset

- Mexico Head Office Dataset

Additionally, if you need a subset of businesses located near an airport or other transportation hubs, contact us. If you need a subset of businesses located near a particular distribution center or closer to an agricultural area, all of this information is easier to see and understand when it’s on a map.

Doing Business In Mexico: Use Data to Save Costs and Drive Revenue

Instant access to Mexico business data will improve your potential for expansion and growth. It will help you determine the best options for cost-effective solutions, as well as identify how you can mitigate risk. For example, accurate location data helps your company identify the best locations for doing business, and the best people and companies within those locations that will help your company realize its objectives.

You’ll be able to make effective decisions faster than your competitors with the right location data, helping you to meet the growing demands of your business and facilitate growth. However, that data needs to be accurate and timely to positively impact business outcomes. When seeking business opportunities in Mexico, location data needs to be flexible, allowing you to filter and manipulate data so that you can analyze it according to your specific business needs.

The Largest Source of Location-Based Mexico Business Data

Accessing location data in large countries can be a major challenge. Many businesses come across unexpected obstacles to accessing the information they need, including bureaucratic issues, and cultural and language barriers. Once information is found, it’s difficult to determine if it’s accurate and reliable. To maximize your use of the data, you need to ensure that it’s accurate, continually updated, and will flow freely into your hands when you need it.

For companies looking to grow in Mexico, Digital Map Products offers the largest and only location-enabled dataset for Mexico business data. Contact us to learn about available data and pricing.

Want to see a sample of the data and how it’s structured?

Click here to download a sample dataset.